Our story

The Rosebank model is based on a proven strategy of ‘Buy, Improve, Sell’.

The founders of Rosebank have a long track record and experience of successfully executing the “Buy, Improve, Sell” strategy. They acquire businesses in which they see potential for further improvement and effect meaningful change through decisive management action and investment. The Rosebank directors cemented their reputation in this field at FTSE100 company Melrose, where they created significant value for shareholders over the course of their twenty year leadership.

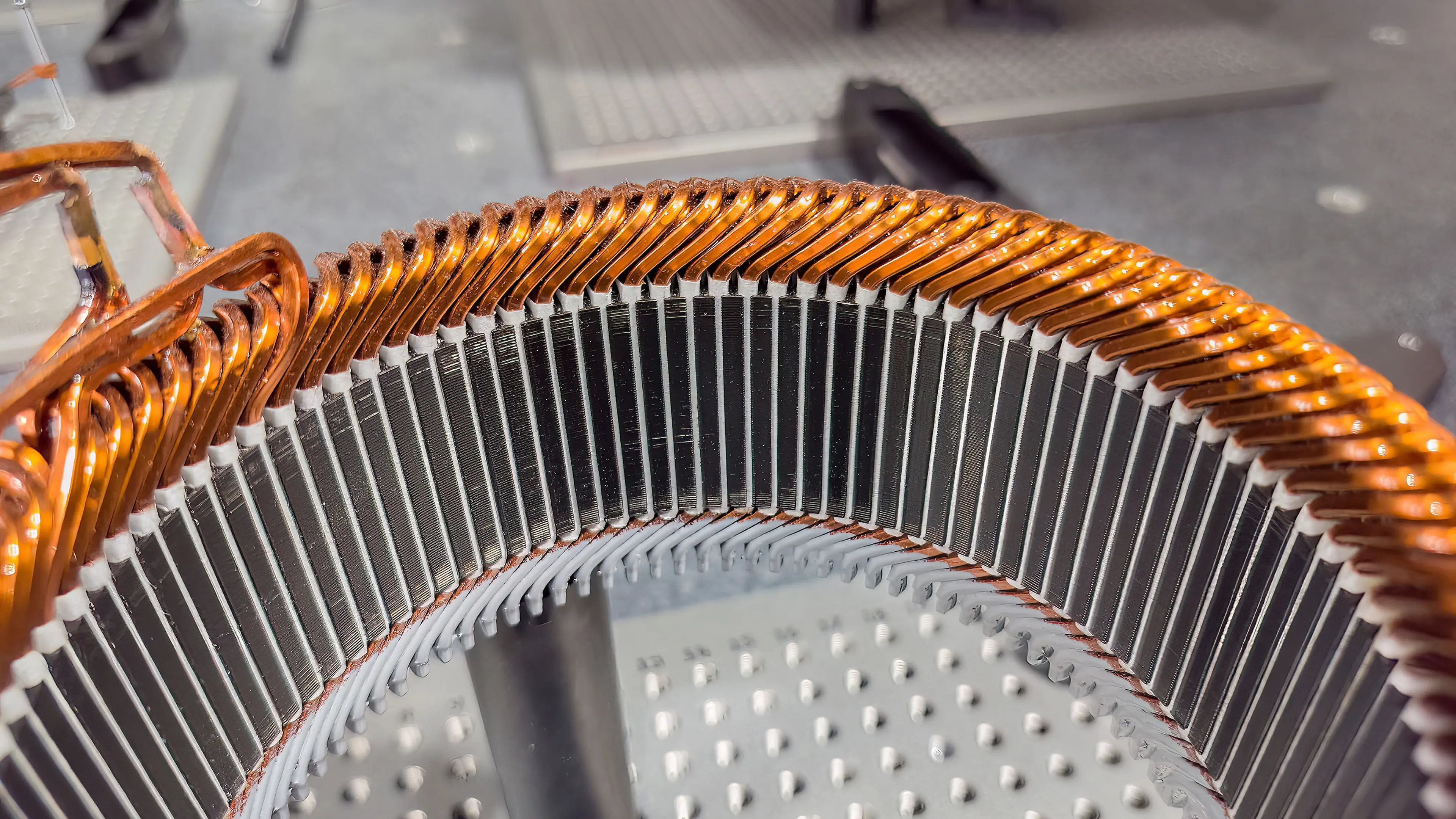

Following Rosebank’s admission to trading on AIM in July 2024, the team was quick to identify its first acquisition, Electrical Components International (ECI), which completed just over a year later. The acquisition of ECI represented the first step in Rosebank’s strategy of acquiring multiple businesses and helping them realise their full potential for the benefit of their customers, employees and shareholders.

Average return on equity for Melrose businesses sold

Returned to Melrose shareholders

Melrose total shareholder return versus 209% for FTSE100

Employing its proven “Buy, Improve, Sell” business model, the Rosebank team has a long and extensive track record of creating significant value over a three to five year period, and returning proceeds to shareholders.